AIFUL CORPORATION (President and CEO: Mitsuhide Fukuda; hereinafter, “the Company”) will raise funds through social loans from Daishi Hokuetsu Bank, Ltd. as described below. Going forward, the Company will diversify its fund procurement methods, including indirect financing through borrowing from financial institutions and direct financing through issuance of bonds, while contributing to the realization of a society that can provide access to financial services for everyone.

Outline of Social Loan

Outline of Social Loan

Implementation Date : December 24, 2024

Lender : Daishi Hokuetsu Bank, Ltd.

Borrowing Amount : 1 billion

Borrowing Period : 3 years

Use of funds procured : Eligible social projects as defined in the Social Finance Framework

Others : Social loans based on the social finance framework, which has obtained "Social 1(F)" from Japan Credit Rating Agency, Ltd. (JCR)

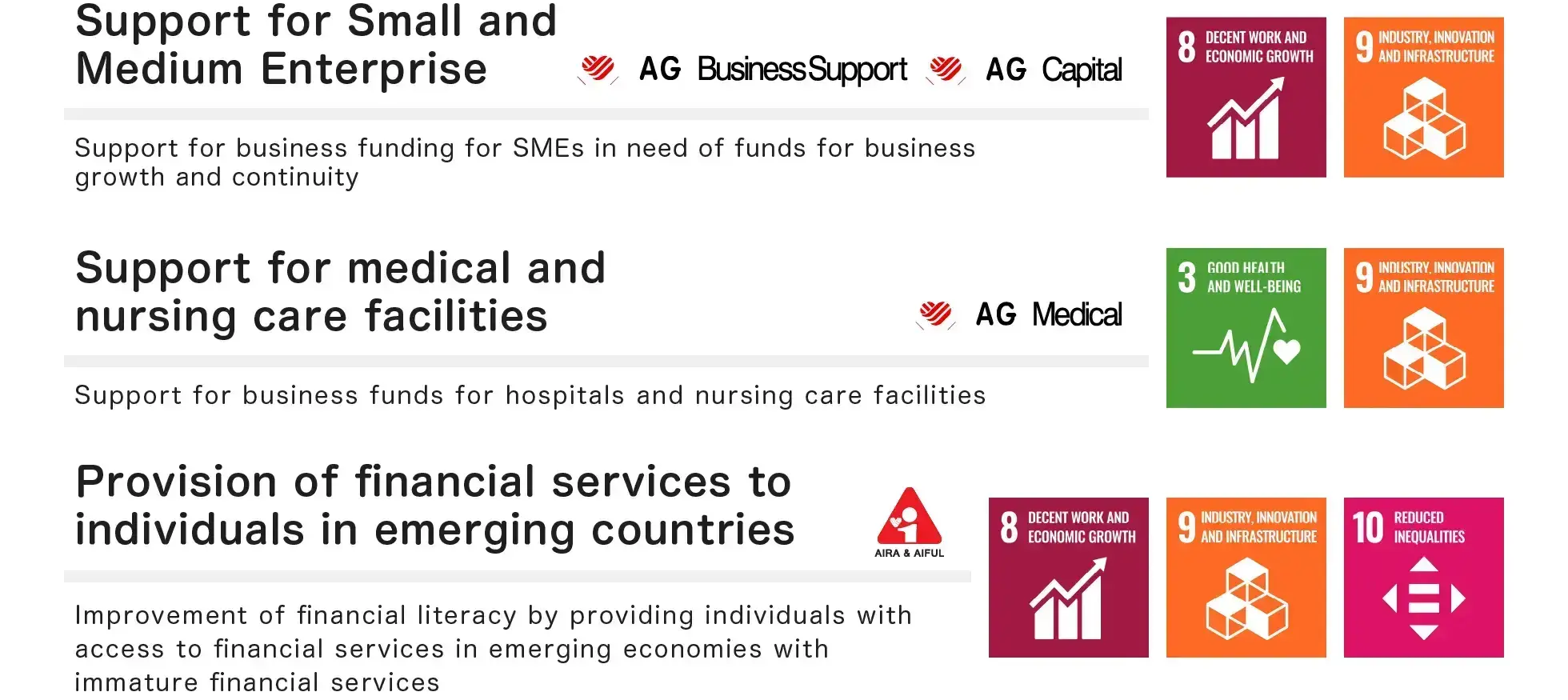

Overview of Qualified Social Projects

Overview of Qualified Social Projects

Third-party Assessment of the Social Finance Framework and Framework Eligibility

Third-party Assessment of the Social Finance Framework and Framework Eligibility

AIFUL has established a Social Finance Framework in accordance with the International Capital Markets Association (ICMA) Social Bond Principles 2021, the Loan Market Association (LMA) Social Loan Principles 2023, and the FSA's Social Bond Guidelines 2021. The Company has received the highest rating of "Social 1 (F)" in the "JCR Social Finance Framework Evaluation" by Japan Credit Rating Agency, Ltd.

For more information on the Social Finance Framework and JCR's evaluation on the Social Finance Framework, please refer to the following website.