Supporting Financing Needs of Digital Age

Supporting Financing Needs of Digital Age

In recent times, with the widespread of smartphones and online services, speed and convenience that customers demand from financial services has accelerated quickly in recent years. Because the traditional methods are centered around physical stores and telephones, it often took a long time from application to service activation, and it was sometimes difficult to provide flexible support. Moreover, providing optimal suggestion support tailored to individual customers required creating a system that can leverage massive amounts of data.

Service Innovations that Leverage FinTech

Service Innovations that Leverage FinTech

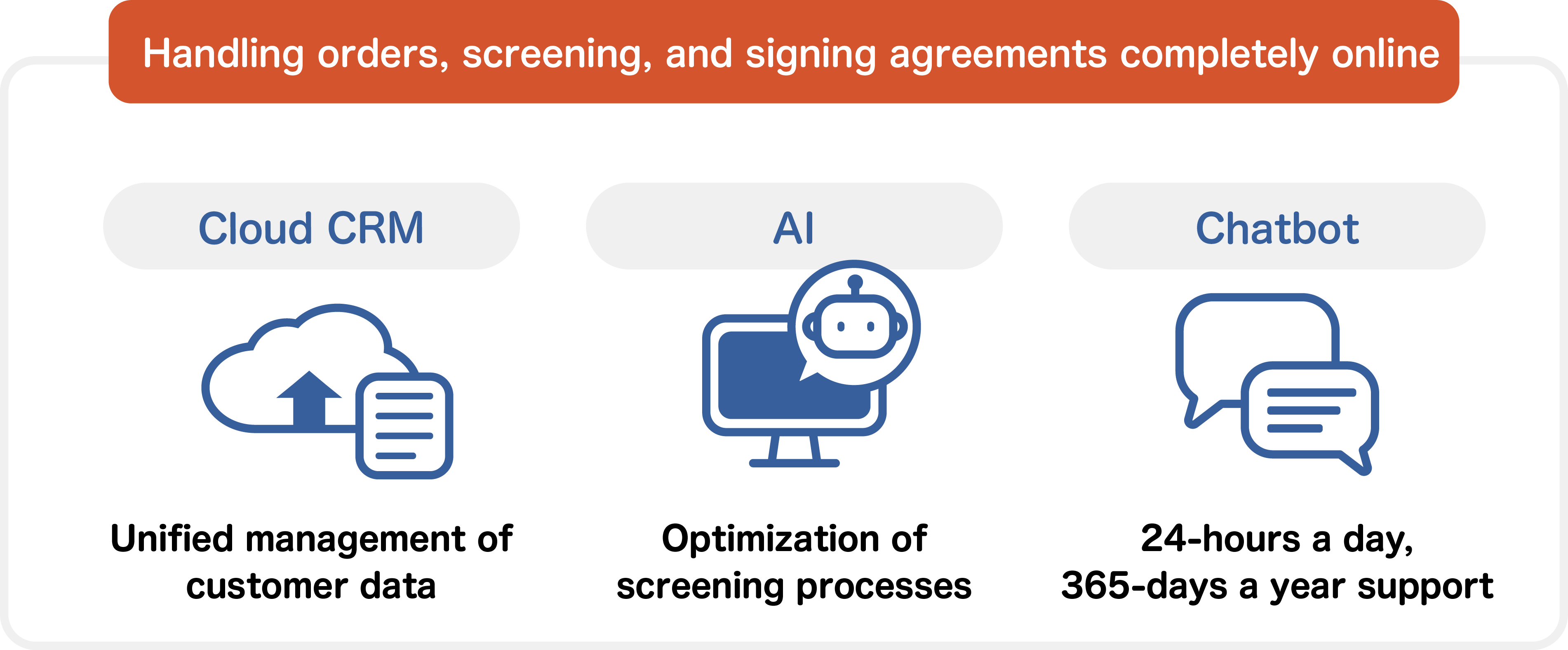

Leveraging the latest FinTech innovations, we established mechanisms for all procedures from screening applications to signing agreements completely online.

・ Implementing a cloud-based CRM that allows the unified management of user data

・ Optimizing screening processes by leveraging AI to reduce processing time

・ Using chatbots and online support, we respond to inquiries 24 hours a day, 365 days a year

For these initiatives, the on-the-ground teams have collaborated closely with our development teams to promote speediness.

Improvements to convenience and a dramatic increase in usage rates

Improvements to convenience and a dramatic increase in usage rates

With completely online handling of procedures, the time needed for steps ranging from placing orders to start of use has been reduced substantially. Moreover, the number of contracts signed and concluded via smartphones has increased substantially compared to before the system was introduced. Customer satisfaction surveys report an abundance of positive comments praising the service as "convenient" and "seamless." Furthermore, by leveraging customer data, we can now make optimal and customized suggestions, which is also tied to improvement in customer retention rates.

Expanding FinTech into More Services

Expanding FinTech into More Services

Going forward, we will expand our FinTech services into a wider range of areas, such as further advancements in AI-based credit scoring models and the provision of cashless payment and personalized drone services. In addition, by continuously incorporating customer feedback to our service, and provide safe, secure, and easy-to-use financing services, we aim to achieve an even better customer experience.

Our Future Direction

Our Future Direction

Going forward, we will further utilize and leverage cloud services and AI capabilities to achieve enhanced automation and personalization. Furthermore, we will expand the areas in which we utilize AI for making suggestions and accelerate data-driven improvements.

Moreover, by building a next-generation contact center that incorporates IVR and chat features, we can enhance and make non-face-to-face customer interactions even more pleasing and continue to evolve into a customer-oriented IT business.