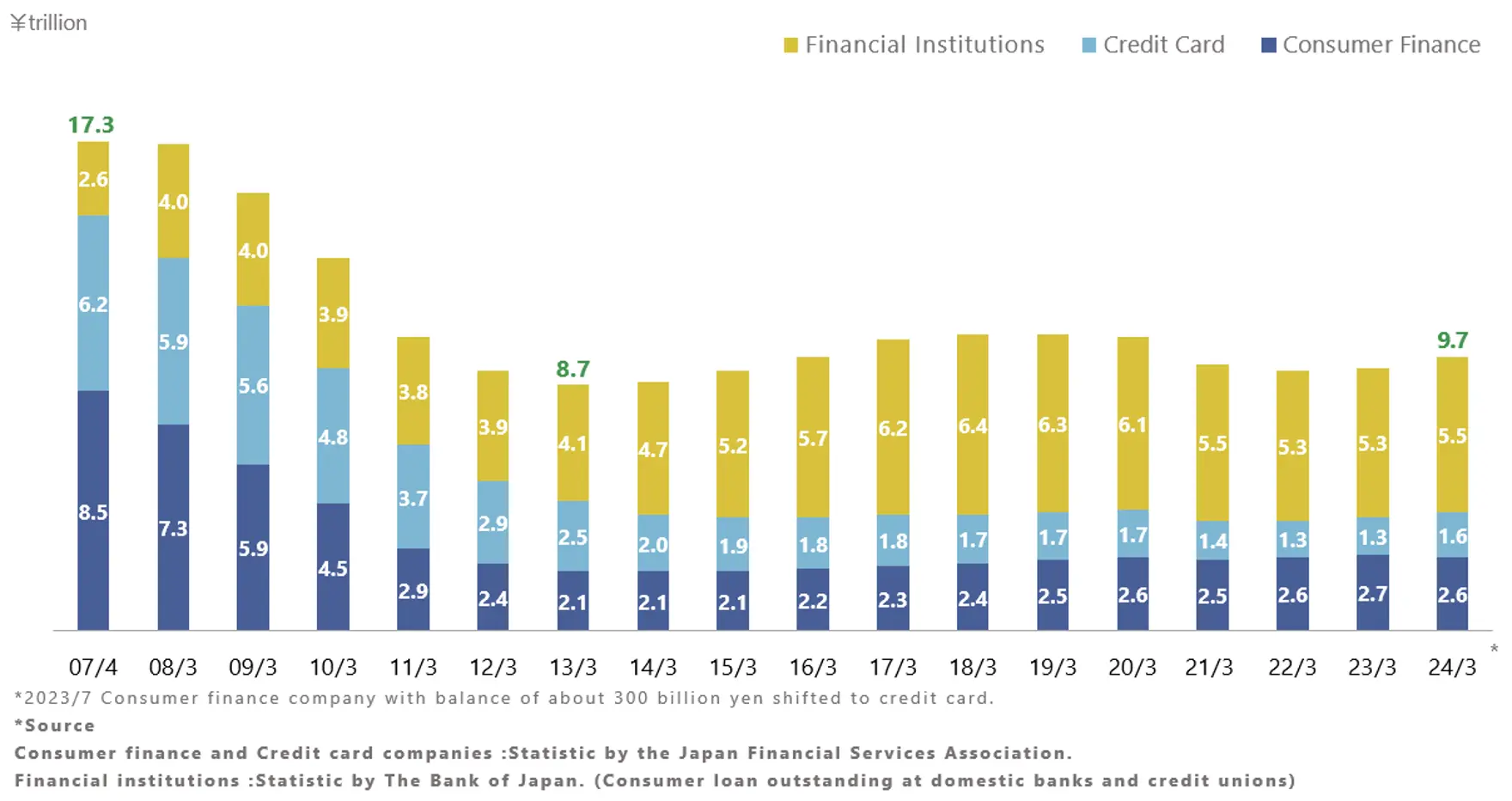

The unsecured consumer loan market in Japan is broadly divided into three categories: loans offered by financial institutions, credit card companies, and unsecured consumer loans provided by companies like ours.

The market size significantly contracted due to the increase in interest repayment claims following the 2006 Supreme Court ruling, as well as the introduction of restrictions on total lending limits under the amended Money Lending Business Act. As a result, the unsecured consumer loan market, which was approximately 17 trillion yen in March 2007, shrank to 8.7 trillion yen by March 2013.

Since 2014, the market has been recovering due to improved economic conditions in Japan and aggressive advertising by banks (bank's card loan) and consumer finance companies. Although the market temporarily declined due to the impact of COVID-19 in 2021, it has been recovering—particularly in the consumer finance sector—and is expected to continue moderate growth going forward.