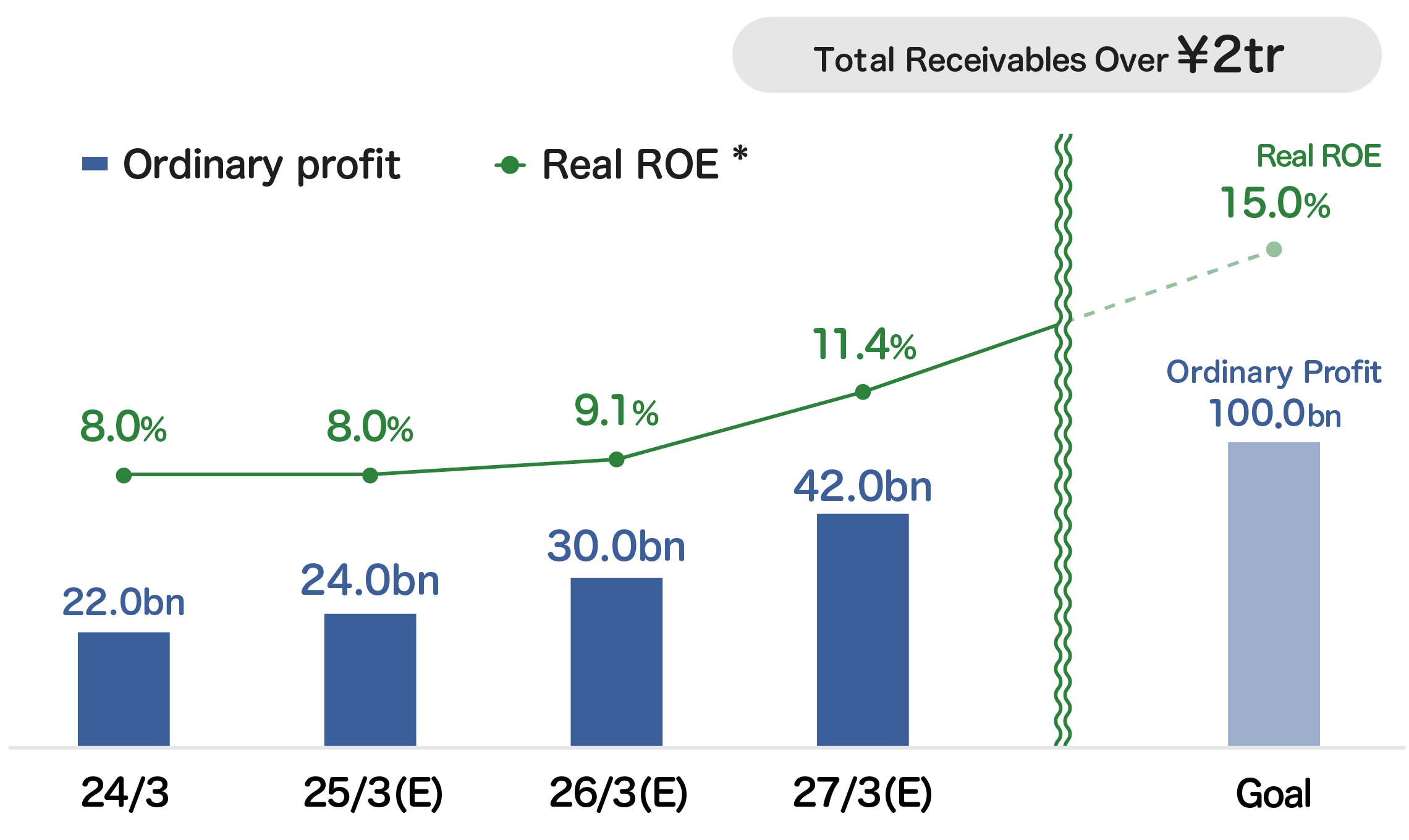

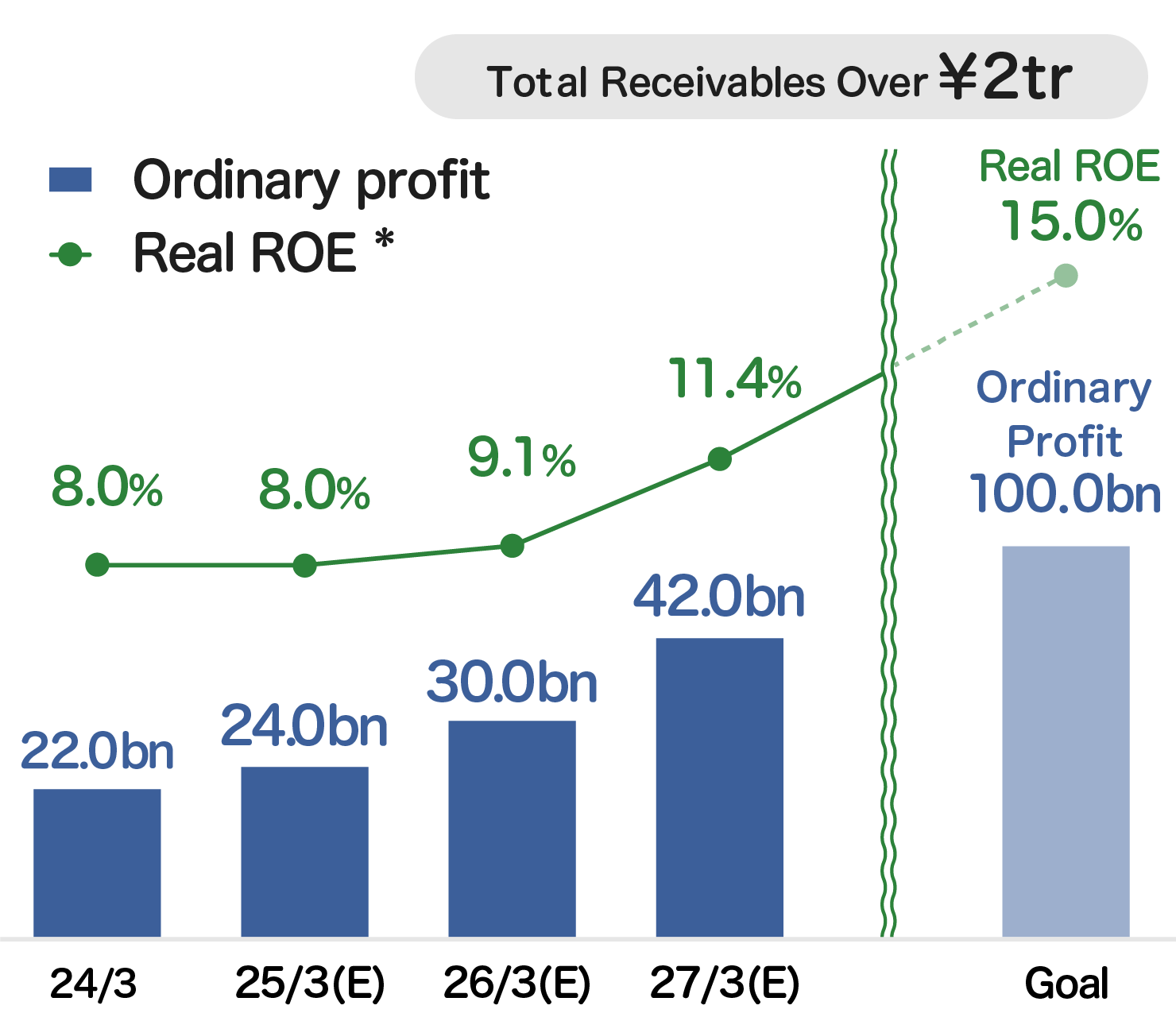

The AIFUL Group aims to transform itself to an IT company that lasts 100 years and has formulated Medium-term Management Plan that ends in the fiscal year ending March 31, 2027 with a long-term goal of reaching 100 billion yen in ordinary profit.

Theme of the Medium-term Management Plan

Theme of the Medium-term Management Plan

Fundamental Policies

Invest in M&A

Invest in M&A to bring changes to the Top-line portfolio composition

Total investment of 60.0 billion yen MAX

Cost Structure Reform

Implement Cost Structure Reform by reviewing human resource compositions and utilizing in-house engineers, etc.

Cost reduction of 5.0 billion yen or more over 3 years

Well-focused investments will be continued centered on the high performing 4 Core Businesses

Consumer finance

Small business loan

Credit guarantee

Installment sales

Financial Indicators

Financial Indicators

*Real ROE is calculated based on Profit attributable to owners of parent assuming an effective tax rate at 30%

| 24/3 | 25/3 (E) | 26/3 (E) | 27/3 (E) | |

|---|---|---|---|---|

| Operating Revenue (billion yen) | 163.1 | 180.0 | 198.0 | 218.0 |

| Ordinary profit (billion yen) | 22.0 | 24.0 | 30.0 | 42.0 |

| ROA (%) | 1.9 | 1.8 | 2.0 | 2.5 |

| ROE (%) | 11.7 | 10.3 | 9.6 | 12.6 |

| Equity ratio (%) | 15.6 | 15.2 | 15.1 | 15.5 |

Capital Policy

Capital Policy

1.Growth Investment

Promote M&A and capital investment of up to 60 billion yen to improve ROE

2.Shareholder Return

Targeting a Total Payout Ratio of around 20%

Please refer to the Medium-term Management Plan for details.